The simple, alarming economic facts that Governments don’t tell you

With all the millions of words written and spoken about the 2015 Budget, as is the case with previous years, the simple and essential facts are hardly mentioned. We barely get the tip of the iceberg.

Summary

“Annual income twenty pounds, annual expenditure nineteen [pounds] nineteen [shillings] and six [pence], result happiness. Annual income twenty pounds, annual expenditure twenty pounds nought and six, result misery.”

- We’ve been spending too much for at least the past 20 years, maybe longer.

- We’ve been living beyond our means, hoping that other people will lend us the money and consigning future generations to pay off the debts we’ve incurred through our over-spending. We can’t afford the level of Government spending!

- When the Government runs a Budget deficit, it is condemning you and future generations to pay for it.

- Governments and politicians have been ‘economic with the truth’. Do they really want us to know how badly they have served us?

The Situation

Before we move onto the facts (expressed both as annual numbers and the cumulative debt position), here are a couple of tips about how to read this blog article to make it easier to digest and more relevant for you. Because the numbers below are mind-bogglingly big (billions, trillions etc). I suggest you do two things:

- ignore the billions, just think of it as £ (or whichever currency is relevant to you)

- imagine you were running your own finances the way the Government does.

Annual figures (rounded to the nearest £billion):

Government Revenue (projected) in 2015-16: £667 billion (£667,000,000,000)

Government Spending (projected) in 2015-16: £743 billion (£743,000,000,000)

Government deficit for this one year: £75.3 billion

Sources: https://www.gov.uk/government/uploads/system/uploads/attachment_data/file/413949/47881_Budget_2015_Web_Accessible.pdf , page 6. The Independent (19 March 2015, Budget Section, page 9)

Let me repeat this: The UK Government, which represents the UK population, is borrowing £75.3 billion (that’s 11.3% of its annual revenue) more than it receives this year alone. And this is an improvement on previous years!

Cumulative figures (i.e. the Government’s financial position):

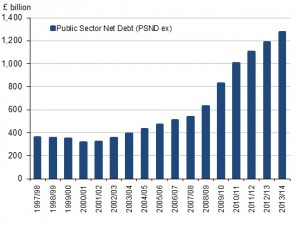

The graph below of UK Government Debt shows the gravity of the situation.

Source: http://www.ons.gov.uk/ons/dcp171778_371085.pdf. Office for National Statistics, Statistical Bulletin, Public Sector Finances, June 2014. Page 15.

The graph shows that in the centuries leading up to the new millennium, including financing two World Wars and covering periods of high inflation, the Government (on our behalf) had accumulated debt of £316 billion. The figure as at December 2014 was approximately £1,483 billion. So, during a time of historically low inflation, in 14 years the Governments had increased our National debt to be nearly 4.7 times higher than it was at a time when its income (i.e. tax receipts) increased around only 1.9 times.

I HOPE YOU ARE SHOCKED BY THE ABOVE FACTS

Some sobering facts, thoughts and things to ponder (plus some of my opinions!)

- When politicians tell you that debt is coming down, they are either lying or not clever enough to understand basic arithmetic. The annual deficit has been getting smaller year on year, and this means that the debt is still rising, but less quickly than in the past (lies, damn lies and statistics).

- When politicians blame the bankers for the mess, they are deflecting the blame (some might say ‘lying’). A significant proportion of the increase in debt and the annual budget deficit are due to consecutive Governments spending more of our money (on public services and social security etc.) than we could afford. We were living far beyond our means. The £80 billion of ‘structural deficit’ that it sometimes referred to was due to the Government borrowing around £40 billion pa when it should have been having an annual surplus during the boom years last decade. I am not defending bankers, merely pointing out that the Government was happy to spend tax receipts from the banker-generated boom, and it can’t blame them for causing the problems when Governments have a duty to regulate banks and understand the economic outlook!

- One of the factors why other some other countries (e.g. Germany) are in a much better situation than us is because they didn’t have such a large structural deficit; 5-10 years of an annual structural deficit of up to £80bn is a big contributor to the overall National Debt of £1.483bn.

- Imagine if your own borrowing had increased nearly five fold at a time when your income had less than doubled (and that some of this increased income was due to unsustainable growth), and that the debt had to be paid off (or ‘serviced’, i.e. interest had to be paid) by you, and your children, their children and possibly their children. How proud would you feel? (Total Government borrowings are 2.2 times it’s annual revenue. If you earned £20,000 pa after tax, imagine having credit card and overdraft debts (excluding mortgages) of around £44,000, even with relatively low interest rates).

- If you spent 11.3% more than you earned, on top of many years of over-spending, how long would it take before lenders would stop lending to you? How grown up and responsible would you feel?

- Interest due on Government debt is around £40 billion pa, more than we spend on the Police and just under half of what we spend on Education.

Concluding remarks

One has to wonder why Governments and politicians don’t simply show us the figures in easy-to-understand terms:

- Government revenue

- Government spending

- Government debt this year

- Cumulative debt

- A few key percentages

I wonder whether they actually want us to know what a mess they have made, are making, and presumably will continue to make. If we really knew how inept they were/are, maybe we would ask some more searching questions on the state of the Nation rather than be so interested in the latest gossip, soap operas or who scored the best goal.

Future articles will cover some tips (both NLP and non-NLP based) about what you can do to help ensure that you can look after your own financial future; after all, you probably can’t trust the Government to do so.